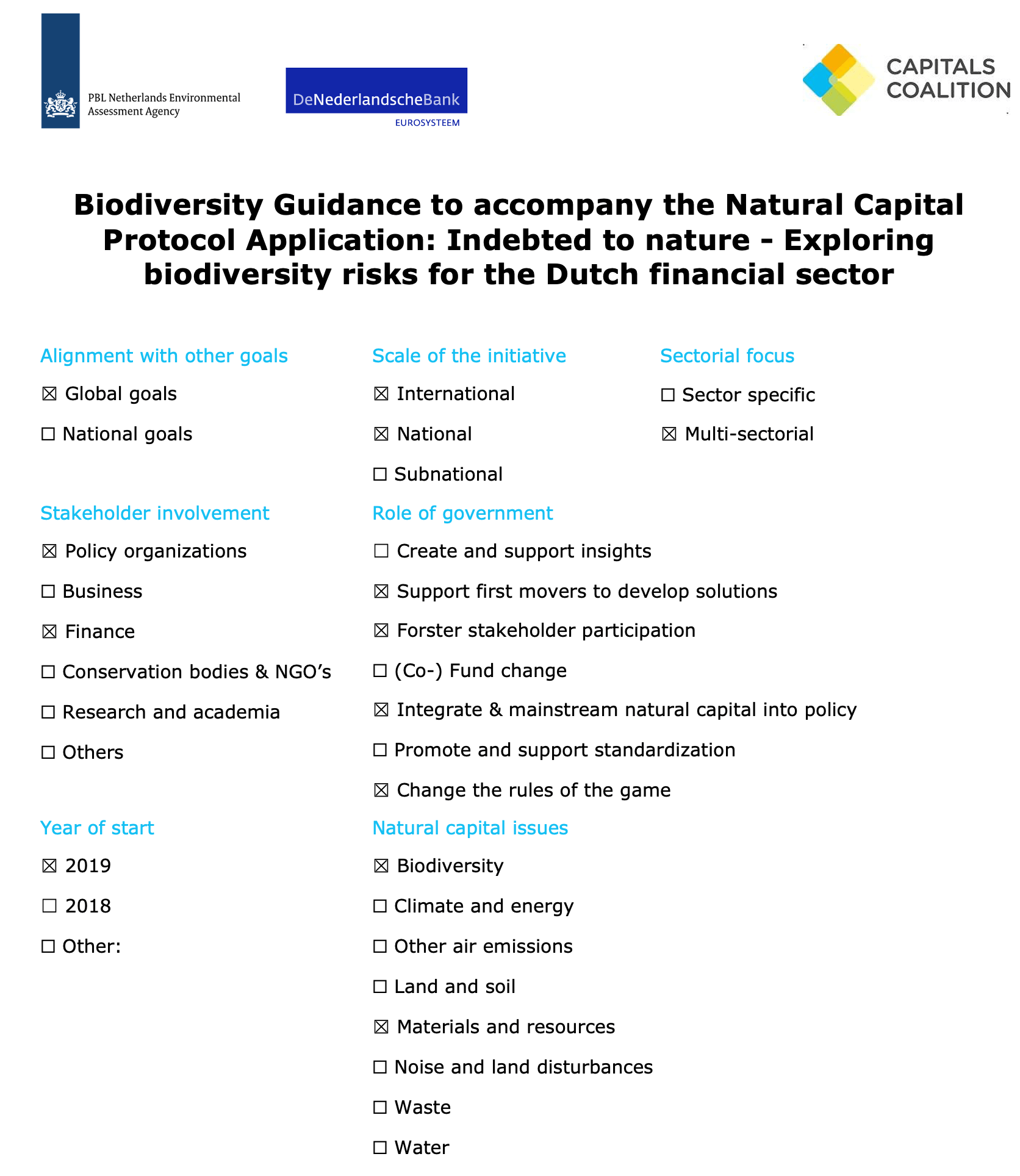

The initiative:

Title: Sustainable Finance Platform – Working Group Biodiversity

Description: In 2016, the Dutch Central Bank (DNB) established the Sustainable Finance Platform. It was set up to promote and increase awareness of sustainable funding in the financial sector. One of the platform’s working groups, which consists of a wide spectrum of financial institutions, is concerned with biodiversity. The goal of the working group is to explore how biodiversity concerns can be integrated in lending, investment, and risk assessment. Case studies have been written by individual member institutions on how they deal with biodiversity opportunities and risks within their organizations.

The organizations: DNB – De Nederlandsche Bank & PBL – Netherlands Environmental Assessment Agency.

Why was this undertaken?

As part of its role as a financial supervisor, DNB explores how sustainability issues may pose risks to the Dutch financial sector. The “Indebted to Nature” study builds on a previous report, “Values at risk?”, published in 2019 by DNB, in which risks of biodiversity loss were investigated in qualitative terms. Now, with the help of the PBL, different risk channels have been analyzed in more detail to quantify the Dutch financial sector’s exposure to biodiversity loss.

The overall exposure of Dutch loans and investments to several risk channels related to global biodiversity decline was assessed. This analysis was performed to determine the financial materiality of biodiversity and to subsequently raise awareness of biodiversity-related risks in the financial sector.

What was the scope?

The analysis explores the exposure of Dutch financial institutions to risks from the loss of biodiversity. Several risk channels have been investigated, encompassing both dependencies and impacts: physical (provision of ecosystem services), reputational (deforestation) and transition (protected area expansion and nitrogen regulation) risks. The choice to analyze these specific risks was based on available financial and biodiversity data. Since this is only a subset of all relevant financial and biodiversity information, the results represent an underestimation of the total exposure to biodiversity-related risks.

What was the role of the Government?

The government was not involved, but several risk channels that are the consequence of policy developments were taken into account. This analysis fits with the targets of the Dutch government on raising awareness on biodiversity-related risks in the financial sector.

What were the results?

Biodiversity loss is a source of financial risks and threatens the availability of ecosystem services, such as provision of materials (for example wood), animal pollination, and soil fertility, on which economic activities depend. As a result:

- Banks, pension funds and insurers that finance economic activities that depend on these ecosystem services face physical risks.

- Financial institutions are also exposed to reputational risks when they finance companies that have a major negative impact on biodiversity, for instance when they are associated with deforestation.

- If companies have to adapt their operations as a result of government policy aimed at reducing the damage to biodiversity, financial institutions financing these companies are exposed to transition risks.

Physical risk

Dutch financial institutions worldwide have EUR 510 billion in exposure to companies with a high or very high dependency on one or more ecosystem services. This comprises 36% of the portfolio examined. Biodiversity enhances the quantity, quality and resilience of many of these ecosystem services. An example of an ecosystem service that depends directly on biodiversity is animal pollination. At a global level, the financial sector’s exposure to products that depend on animal pollination amounts to EUR 28 billion.

Reputational risk

Dutch financial institutions provide funding of EUR 97 billion to companies involved in environmental controversies. Negative impact that can be traced back to a specific company can result in reputational damage for the company itself as well as for the financial institutions funding it.

Transition risk

As an example of a transition risk, the transition to less nitrogen-intensive business models can expose EUR 81 billion in loans – that the largest three Dutch banks have provided to Dutch sectors – associated with nitrogen-emitting activities to transition risks.

What impact on decision making did it have?

It’s too early to say, financial institutions are encouraged to do further analyses on exposure to biodiversity-related risks in their portfolios. The Dutch Government welcomes these analyses, and encourages DNB to continue with these.

Next steps:

DNB recommends that financial institutions identify the exposure of their own portfolios to biodiversity risks, since understanding these risks informs adequate risk management. When material risks appear, appropriate management and mitigation of these risks is needed.

It is also recommended to develop consistent and broadly applicable standards for measuring and reporting on biodiversity risks. This will require the efforts of policy makers, supervisory authorities, financial institutions and researchers.

![]()