The organization/ department in brief

The Netherlands Enterprise Agency (RVO.nl) is a governmental agency that stimulates and encourages sustainable, agricultural, innovative and international entrepreneurship in the Netherlands. The agency supports Dutch enterprising with subsidies, finding business partners, knowledge and compliance with laws and regulations. The aim is to improve opportunities for entrepreneurs and strengthen their position.

RVO.nl is part of the Ministry of Economic Affairs and Climate, but also carries out assignments on behalf of other ministries, including the Ministries of Agriculture, Nature and Food Quality, Foreign and Interior Affairs and Kingdom Relations. RVO.nl also works on behalf of the European Union.

Why was this undertaken?

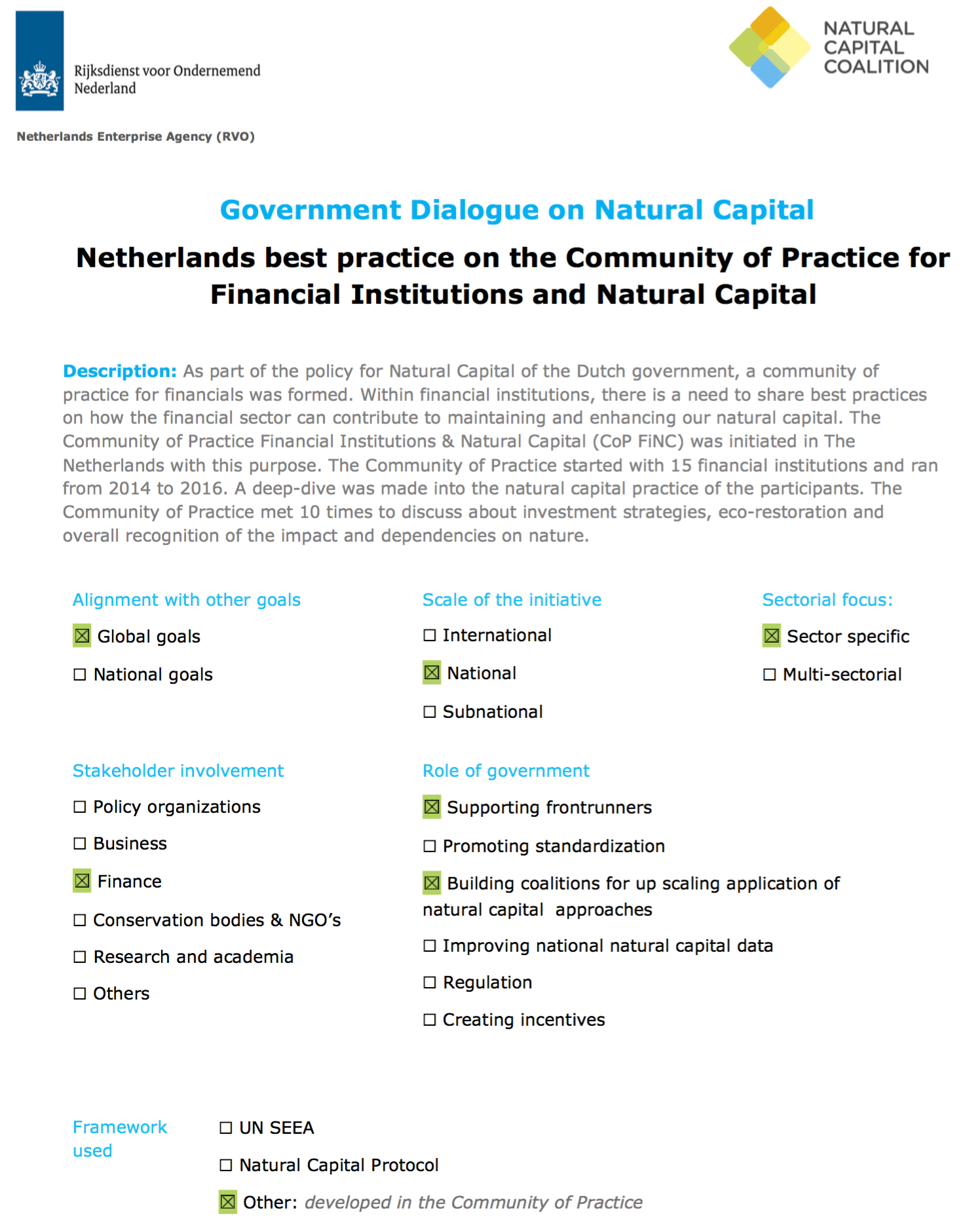

For the Ministry of Economic Affairs and Climate, the Community of Practice for Finance and Natural Capital was an initiative to accelerate the green growth policy, which aims to preserve and strengthen natural capital and sustainable investments in the Netherlands’. The Netherlands is in the take-off phase which means that there are highly ambitious frontrunners and some mainstream players are moving slowly. The Dutch government aims to move to the phase of the critical mass in which stakeholders collaborate to tackle obstacles that inhibit sustainability and governments institutionalize the agenda and expand the drivers of change. The Community of Practice accelerated the process of learning and supported implementation, both on strategic level and practical application, by sharing knowledge and experience.

What was the scope?

The Community of Practice in Finance and Natural Capital was a network that focuses on the role of finance in greening the economy and consisted of people who were intrinsically motivated, open to cooperate and wanted to explore new pathways. In the Community of Practice people brought knowledge, learnt from each other and took insights to their daily practices. The Community of Practice identified opportunities and barriers in policy and established effective dialogue with governments. Coalitions and standardization pave the way towards a green and resilient economy.

Besides the results on the level of the individual members (micro level in transition theory), the Community of Practice also strived to have an impact on a higher system level such as: working group blended finance for green investments, support Platform Carbon Accounting Financials, contribute to the development of ´Connecting Finance and Natural Capital: a Supplement to the Natural Capital Protocol’, contribute to the Natural Capital Guide for the financial sector, contribute to the Dutch policy dialogue on Natural Capital, among others.

What were the results?

Individual participants are accelerating their implementation of green investment in their strategy. For instance, ASN Bank and FMO were able to display and determine their total CO2 emission of their balance sheet. In addition, the continuous dialogue between companies, institutions and organisations is an effective method to reduce the (negative) impact on natural capital. The Community of Practice acquired a growing information and insights of the financial sector. As a result, it became clear which systems opportunities and threats exists in the process of greening the financial sector. Companies and organizations worked on implementing transparency in their greening strategy. Companies started to operate with a more sharing and communicative character towards natural capital and green finance. The success was based on experienced and committed people, mutual trust and openness to exchange knowledge and experience.

After the CoP FINC was finalized in the Netherlands, a great interest arose from the European Union. As a result, the Directorate-General for Environment (DG ENV) established the Community of Practice Finance@Biodiversity (CoP F@B), which started in 2017. CoP F@B focuses on financial institutions and their integration of biodiversity in decision-making . The Community of Practice and the expressed interest from financial institutions in Europe will be the starting point to build further on the emerging ecosystem perspective for finance. Additionally, this Fall 2018 a Community of Practice (CoP) will start in Africa about financing water in the context of the broader landscape (Integrated Water Management: IWRM): 15 innovative financial institutions investing in IWRM-projects will come together for a period of 2 years to learn from each other how to address barriers and develop best practices.

What was the role of the Government?

The Government gave RVO.nl the assignment to create and facilitate the community of practice for financial institutions. The government has been instrumental in the accumulation and assimilation of the results, which are written in the eBook Finance for One Planet. The government introduced the results of spin off projects and platform such as the Platform carbon accounting Financial and the green taxonomy working group of Directorate-General for Financial Stability, Financial Services and Capital Markets Union (DG FISMA). In addition, the Dutch Ministry introduced the concept of a Community of Practice at an European level with a new Community of Practice set up.

The financial sector can be a significant enabler in a transition towards a green economy. However, the question for individual financial institutions is to define its ambition and responsibility in line with this transition. To make a green economy the new starting point, inclusive and structural change is needed in the financial sector. Collaboration on data sharing with new partners, the scientific community and disclosure on local impact data, such as land and water are prerequisites for the financial sector. Financial institutions have to push together for disclosure of data on production locations to gather the necessary land and water indicators. Collaboration is also the way to change the sector regarding financial risk and the risk models that are used at present.

In The Netherlands different spin-off projects of the Community of Practice are supported such as a Round Table for Financial Institutions on zero deforestation, the Platform on Biodiversity Accounting Financials (PBAF) and an online Greening Finance Community is set-up

Other comment

The report that summarize the outputs of the Community of Practice of Financial Institutions and Natural Capital is accessible through this link.