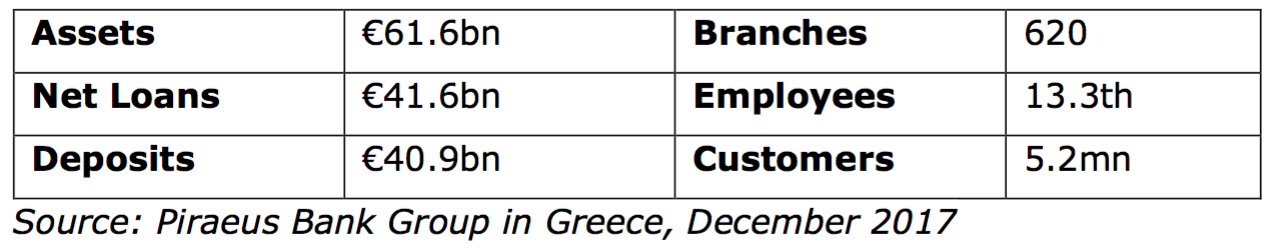

The financial institution in brief:

Headquartered in Athens, with approximately 13.3th employees, Piraeus Bank Group offers a full range of financial products and services to approximately 5.2mn customers in Greece. Total assets of the Group in Greece amounted to €61.6bn, net loans to €41.6bn and customer deposits to €40.9bn on December 31, 2017.

Piraeus Bank today leads a group of companies covering all financial activities in the Greek market (universal bank). Piraeus Bank possesses particular know-how in the areas of medium-sized and small enterprises, in agricultural banking, in consumer and mortgage credit and green banking, capital markets and investment banking, as well as leasing and factoring. These services are offered through nation-wide network of 620 branches and 2,019 ATMs, and also through its innovative digital banking platform winbank.

Piraeus Bank aims to differentiate itself with the provision of superior standards of customer service, adopting modern technological solutions. In this context, an electronic branch, known as “e-branch”, was set up and operates since 2016. This is a completely new concept for the Greek market. Piraeus Bank currently has 4 e-branches in which transactions are carried out with speed, convenience and security.Piraeus Bank Group, possesses an international presence in Southeastern Europe as well as in London and Frankfurt consisting of 133 branches.

The year 2017 was a critical juncture for Piraeus Bank. From a financial point of view, this was the year which signaled the stabilization of the Bank’s financial performance. The improvement in liquidity and asset quality accelerated and that was visible across financial ratios. On an institutional level, the year was characterized by the completion of the changes in the Board of Directors, incorporating members with international financial expertise and strengthening its corporate governance, in compliance with international best practices and regulatory rules. At the same time, Piraeus Bank has reinvigorated its top management, strengthening its executive management team. The year 2017 was sealed with our new CEO taking office on April 2017 Mr Christos Megalou. The institutional ring-fencing of the Bank allows further strengthening and unceasing operational continuity to the benefit of our shareholders, customers and employees.

Piraeus Bank now possess the necessary know-how, the experience and the decisiveness to address today’s challenges and to ensure that the Bank is well positioned to deliver against the demanding operational and corporate governance requirements, which are derived from the best international practices, as well as from ECB’s recommendations.

Why use natural capital thinking?

Piraeus Bank has been dealing with environmental issues since 2004. Biodiversity is described within the corporate responsibility policies and strategies of Piraeus Bank Group (Environmental Policy 2010); in the Codified Articles of Association where reference is made to sustainable use of natural resources; in the Manual of credit policy and practice: General Principles of credit policy, where reference is made to the heightened due diligence required for investments in Natura 2000 sites. In the Corporate Responsibility Report (2015) specific references are made in Chairman’s Note (p.8), Corporate Responsibility Principles (p.29), Piraeus Group corporate responsibility strategic targets (p.31) and 2016 Key Targets (p.143). Moreover, in the context of compiling the Annual Report a materiality survey based on a questionnaire highlighted biodiversity as one of the material to be taken into consideration by the Piraeus Bank Group (p.12-15).

Piraeus Bank Group endorsed the Declaration of Antwerp, which raises the issue of refocusing the ecosystem services framework on the principles of sustainability and social justice, in the context of Ecosystem Services Conference 2016 in Antwerp. The Habitats and Bird Directives (Natura 2000 network) are the major EU policies for shaping our biodiversity strategies. The major obstacle (in Greece) is the unclear rules (what is and what is not allowed in Natura 2000 sites), in terms of business opportunities.

What was the approach?

Sustainable management & financing of wetland biodiversity

The case of Lake Stymphalia is an innovative project carried out by Piraeus Bank. The project is co-funded by the European Commission through the financial instrument LIFE+ Nature and Biodiversity and runs from 01.10.2013 to 29.09.2018. The aim of the project is the restoration of Lake Stymphalia and its long-term protection and management, through a systematic re-financing process, which will be ensured by the utilization of the area’s biomass and other renewable natural resources, combined with low-impact commercial activities.

The LIFE-Stymfalia project is 50% co-funded by the European Union’s LIFE+ funding instrument. Total project budget: is € 2,013,290 with EC financial contribution of € 1,006,646. Associated beneficiaries are Piraeus Bank Group Cultural Foundation (PIOP), Municipality of Sikyonion, OIKOM Environmental Studies Ltd, Society for the Protection of Prespa and Centre for Renewable Energy Sources and Saving (CRES).

A Business Plan is being prepared in order to explore the sustainability of a potential business scheme, through which the funding of the restoration and preservation of the Lakes’ biodiversity and natural capital can be achieved in the long run. The Bank is working with biodiversity experts to prepare a manual of KPIs to measure progress, this will be published alongside the final report. The final Business Plan will include the identification of additional business opportunities for the funding of the Lake’s management and identification of potential investors. This identified positive contribution will be used as an opportunity to attract investors in the area.

What were the outcomes of the assessment?

In the Life project with the restoration of Lake Stymphalia Piraeus Bank tries to establish a sustainable natural capital management scheme that will bring life back to the wetland. The challenge is to attract businesses that are willing to finance biodiversity and to promote the business case for biodiversity investment. This is not as easy as for climate change, where the price of carbon is the common denominator.

Next steps

Piraeus Bank is also currently reviewing its ‘Sustainability Policy’, with reference to biodiversity. The Bank wants to develop and mainstream tools and methodologies to measure impacts of investment portfolios on biodiversity. The Bank is working on another project to engage/energize SMEs in agriculture, tourism and fisheries and to set up a business and biodiversity hub in the South of Greece.

Piraeus Bank will work on investment strategies and approaches that have a positive impact on biodiversity, through finding pro-biodiversity projects and understanding how to effectively invest in nature. This involves connecting with the United Nations Environment Programme Finance Initiative to work on positive impact. UNEP FI is a partnership between United Nations Environment Programme and the global financial sector with a mission to promote sustainable finance. The initiative consists of a group of 200 financial institutions, including banks, insurers and investors in which Piraeus Bank joined in 2007. UNEP FI started a Working Group on Positive Impact Finance which released the Positive Impact Manifesto. In the Manifesto they call for a new financing paradigm, starting with defining ‘Positive business’: “It is that which serves to deliver a positive contribution to one or more of the three pillars of sustainable development (economic, environmental and social), once any potential negative impacts to any of the pillars have been duly identified and mitigated”.

Piraeus Bank is also an active member of the EU Community of Practice (CoP) for Finance and Biodiversity.

Since the end of 2017, Piraeus Bank is participating in a project run by IUCN called “Incubator for Nature Conservation” whereby in the pilot phase 10 protected areas from different regions of the world have been selected. The objective is to find solutions for engaging the private sector to establish sustainable financing systems in the areas. One of the selected sites is a protected lake in northern Greece (Lake Pamvotis). Piraeus Bank is participating in the Expert Working Group set up by IUCN for the purpose of this international project.