The company in brief:

Novartis is a multinational pharmaceutical company based in Switzerland, and one of the largest pharmaceutical companies by both market cap and sales. Novartis develops, manufactures, and markets healthcare products, providing solutions for patients worldwide. The company operates in the segments of innovative pharmaceuticals, eyecare, generics, vaccines/diagnostics and consumer health.

Why a natural capital assessment?

Novartis wanted to use the Natural Capital Protocol to estimate its environmental externalities as a monetized value. Novartis set out with the objective to measure, value and compare relevant natural capital impacts and dependencies for their direct operations and materials supply chain, for specific country scopes. Their interest was in understanding risks and opportunities in different geographical and operational areas, and comparing impacts and dependencies to identify hotspots. In addition, Novartis also wanted to quantify the social and environmental benefits of their forest carbon sink projects.

How was the Natural Capital Protocol used?

The scope of the Pilot test carried out by Novartis included the following:

- Audience – Internal and external stakeholders were considered in focusing the assessment

- Organizational focus – Novartis Group operations (corporate) plus selected country scopes considered most relevant in the materials supply chain (India, China) and to environmental profits achieved through forestry carbon-sink activities (Argentina)

- Value chain boundary – Greenhouse gas (GHG) and water footprint of materials supply chain; Air emissions of energy supply chain; Pharmaceuticals in Environment (PiE) micro-pollutant impact in water of product use (customers); Energy, water and waste costs (already internalized costs)

An additional goal for Novartis was to better understand and test methods of valuing natural capital in monetary terms. The valuation included environmental impacts described above, from both direct operations and materials supply chain. The extent of these impacts was estimated using a macro-economic input/output model and statistical tools that incorporated data sourced internally and externally to the business.

For measuring and valuing impacts and dependencies, Novartis:

- Considered the use of globally valid prices for carbon (GHG) and ozone depleting substances; European prices for societal impacts involving water risks, air emissions, and waste disposal, normalized with country specific GDP/capita information

- Formally introduced a shadow carbon price of USD 100/ton CO2e as part of the Vision 2030 on Environmental Sustainability and applied this in the analysis

- Applied internal assessment and data collection tools, as well as tools and data from secondary sources, e.g. Delft Shadow Price Handbook

- Novartis used their natural capital assessment as an opportunity to consult among a wide stakeholder base that included internal (HSE, Corporate Social Responsibility, Communications, Group Finance) and external (World Business Council for Sustainable Development, Quantis, Natural Capital Coalition, University Basel) stakeholders.

What were the outcomes of the assessment?

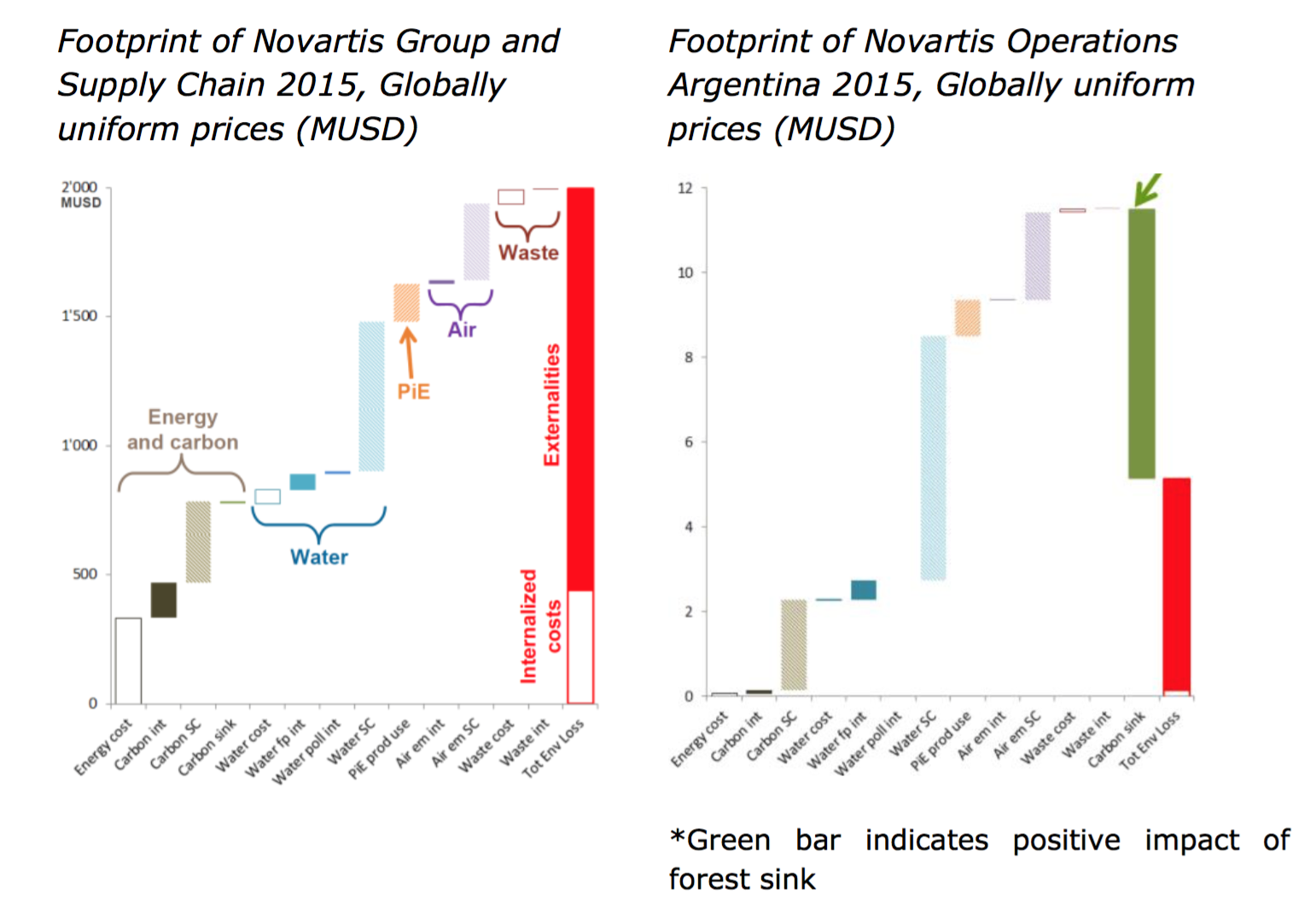

Novartis successfully quantified their environmental footprint at both corporate level and for specific operational areas, measured their externalities relative to internalised costs, and compared this with the positive impacts of their social/environmental programs as shown in Figure 1. Novartis applied globally uniform prices on all impact areas, and prices normalised with GDP/capita for some areas.

The results of the Natural Capital Protocol assessment confirmed that carbon and other air emissions, as well as water use along the supply chain, are the major external environmental costs for Novartis. Measuring and valuing natural capital using the Protocol helped Novartis to confirm and realign key priorities within their environmental strategy based on the materiality of impacts and dependencies.

Figure 1. Novartis natural capital valuation and comparison with forest sink project work

These results instantly became a driver for making Supply Chain and Procurement functions more aware of the importance of their decisions on the environmental footprint of the company, and to identify opportunities of improving performance. One example is energy use, where Novartis have through a comprehensive programme over several years managed to make up to 20% savings via activity improvements.

Another learning was that environmental or social benefits from forest sink projects reach similar or greater returns than from carbon sequestration alone. Carefully designed forestry projects were found to be net positive through protection of watersheds and increasing biodiversity, as well as for social development and long-term economic growth in project areas.

In terms of gaining internal support for natural capital, Novartis was successful in pairing this emerging area of work with its existing and already internally accepted social impact programmes.

Next steps:

Following the Protocol, Novartis identified several areas for future work, such as broadening their analysis of supply chain impacts and dependencies, and continuing to embed these learnings throughout their organisation. Novartis also intend to follow up with key suppliers to realise performance improvements in specific areas.

Their initial natural capital assessment led to a follow up process for the assessment of Social Return on Investment (SROI) of specific environmental projects (Novartis Forestry Carbon Sink projects). Novartis would like to enhance understanding of the value of environmental benefits such as reforestation habitats, biodiversity, native species, watershed protection, etc. and to make links between environmental and social impacts even more explicit, e.g. for water usage, pollution, and consumption, for example.

Findings from the Natural Capital Protocol were integrated into a broader Financial Social and Environmental Profit & Loss (FES P&L) project within Novartis that will continue to grow in scope. Natural capital valuation is becoming an accepted part of the Novartis corporate program on environmental sustainability, and integration of environmental and social valuation into Corporate Responsibility programs is progressing.