The financial institution in brief:

BNP Paribas Asset Management is a leading provider of quality investment solutions for individual, corporate and institutional investors. We have around EUR 421 billion assets under management, over 3000 staff in 30 countries. We are backed by BNP Paribas Group, whose scale and A+ rating gives us and our clients the secure foundation to invest and make a positive difference in people’s futures.

We are ‘the asset manager for a changing world’, because we have organised ourselves to be able to stay at the forefront of developments while maintaining an unwavering focus on what our clients want most – long-term sustainable investment returns, built on the firm foundation of quality assets.

BNP Paribas Asset Management has been a major player in sustainable investment since 2002. We have a dedicated multi-disciplinary team of 25 ESG professionals within the Sustainability Centre, with financial, economic and legal expertise. We are a member of advisory committees at international bodies such as the PRI, the FSB TCFD and the IIGCC. BNPP AM was ranked first-in-class (A+) by PRI for its approach to responsible investing.

With the announcement of our Global Sustainability Strategy in March 2019, we took our commitment further with a firm-wide approach and ambitious firm-wide targets, including applying sustainable investment across our full range of investment strategies by 2020, and aligning our portfolios with the Paris Agreement goals by 2025. We also manage EUR 37 billion (as of December 2018) in impact, thematic and socially responsible investment (SRI) strategies for those clients who wish to allocate to more specific sustainable investment opportunities.

Along with climate change and the need for a more inclusive growth, natural capital occupies a central role in our approach. Indeed, we regard three issues as critical pre-conditions for a more sustainable and inclusive economic system – energy transition, environmental sustainability and equality and inclusive growth – and are aligning our investment research, portfolios, and company and regulatory engagements in support of each. We call these the ’3Es’.

In line with this focus, we will track, monitor and publicly report on indicators related these 3Es, such as water footprint and deforestation under ‘Environmental sustainability’.

Why use natural capital thinking?

BNPP AM has been an early adopter of Natural Capital thinking and aims to limit its natural capital footprint.

But today, data gaps make measuring impacts and dependencies on natural capital challenging.

This is why BNPPAM is trying to address these gaps through enhanced sector specific ESG analysis of companies to map ‘hot spots’, raise awareness and ultimately be incorporated into investment decisions.

What was the approach?

Objective

In line with the Natural Capital Coalition’s objective to develop an Oceans Supplement to the Natural Capital Protocol, we decided to focus our qualitative assessment of the food retail sector on two critical issues impacting the sustainability of our oceans:

- Analyse the seafood sourcing of European companies in the Food Retail sector (our main exposure to seafood activities is through Food Retail and Catering)

- Analyse their plastic/packaging strategies

This assessment is then integrated into BNPP AM’s ESG scores as a qualitative overlay of up to +/-30%, as well as being used as a basis to engage with companies to promote adoption of best practices.

Scope

We focused this dual assessment of seafood sourcing and plastic/packaging strategies on all European companies in the Food Retail sector that are constituents of the MSCI Europe. For the plastic/packaging strategy assessment, we also covered global soft drinks manufacturers and Consumer Home & Personal Care Products companies.

Data

We used a combination of primary and secondary data:

- from companies (websites, Corporate Social Responsability reports, annual reports, one-to-one conversations)

- from BNPP AM’s ESG data providers

- from mainstream and SRI brokers

- from civil society/NGOs such as WWF, Ellen MacArthur Foundation, Fish Tracker Initiative, Global Fishing Watch, etc.

- from international/industry bodies such as UNEP, European Commission, FAO, etc.

We did the assessment in July/August 2018.

Assessment

Focus A: Seafood sourcing

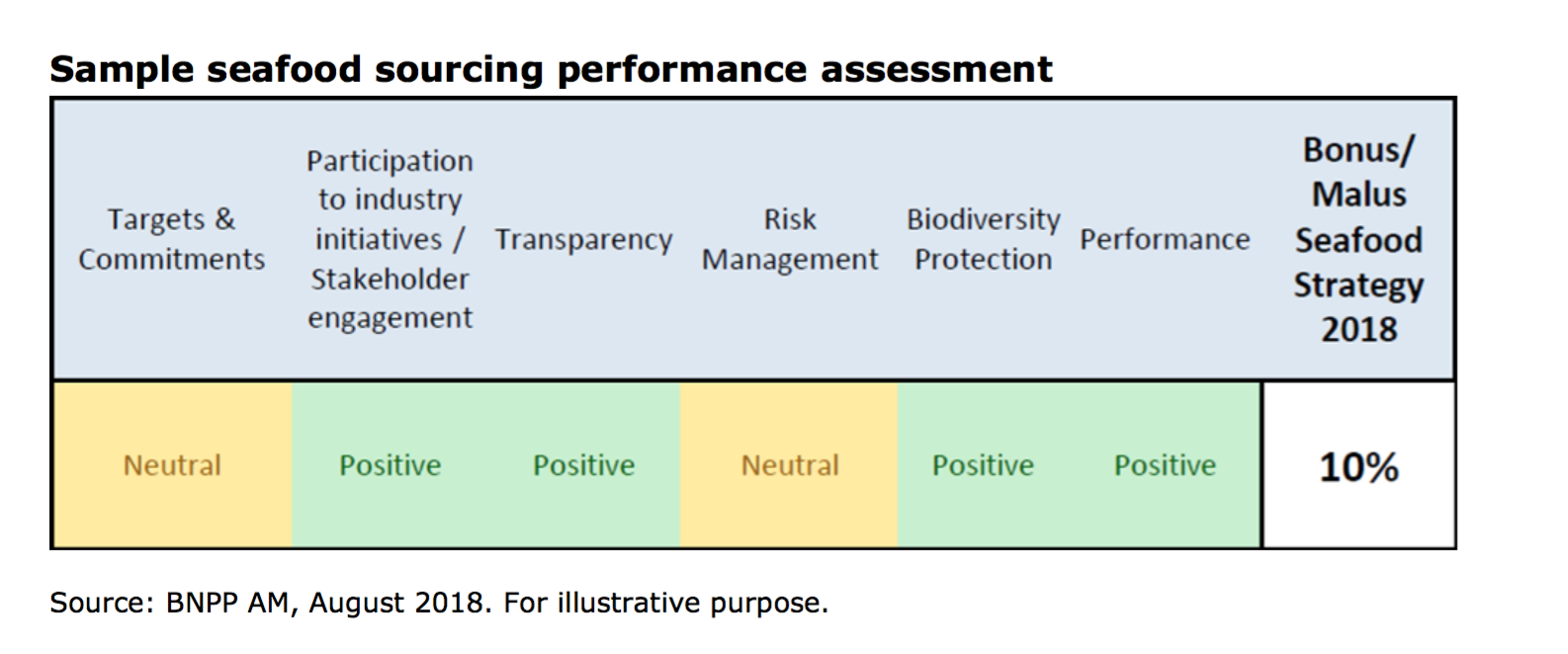

In this analysis, we made a qualitative assessment of the companies’ efforts on six criteria:

- Targets and commitments

- Participation to industry initiatives / Stakeholder engagement

- Transparency

- Risk management

- Biodiversity protection

- Performance

Based on this assessment:

- We assigned companies a positive, neutral or negative view for each criteria

- We gave each company a bonus/malus for their seafood strategy if it performed above/below its peers

Focus B: Plastic/packaging strategies

In this analysis, we made a qualitative assessment of the companies’ efforts on five criteria:

- Targets and commitments

- Participation to industry initiatives / Stakeholder engagement

- Transparency

- Performance

- Waste management

As for seafood sourcing, based on this assessment:

- We assigned companies a positive, neutral or negative view for each criteria

- We gave each company a bonus/malus for their plastic/packaging strategy if it performed above/below its peers

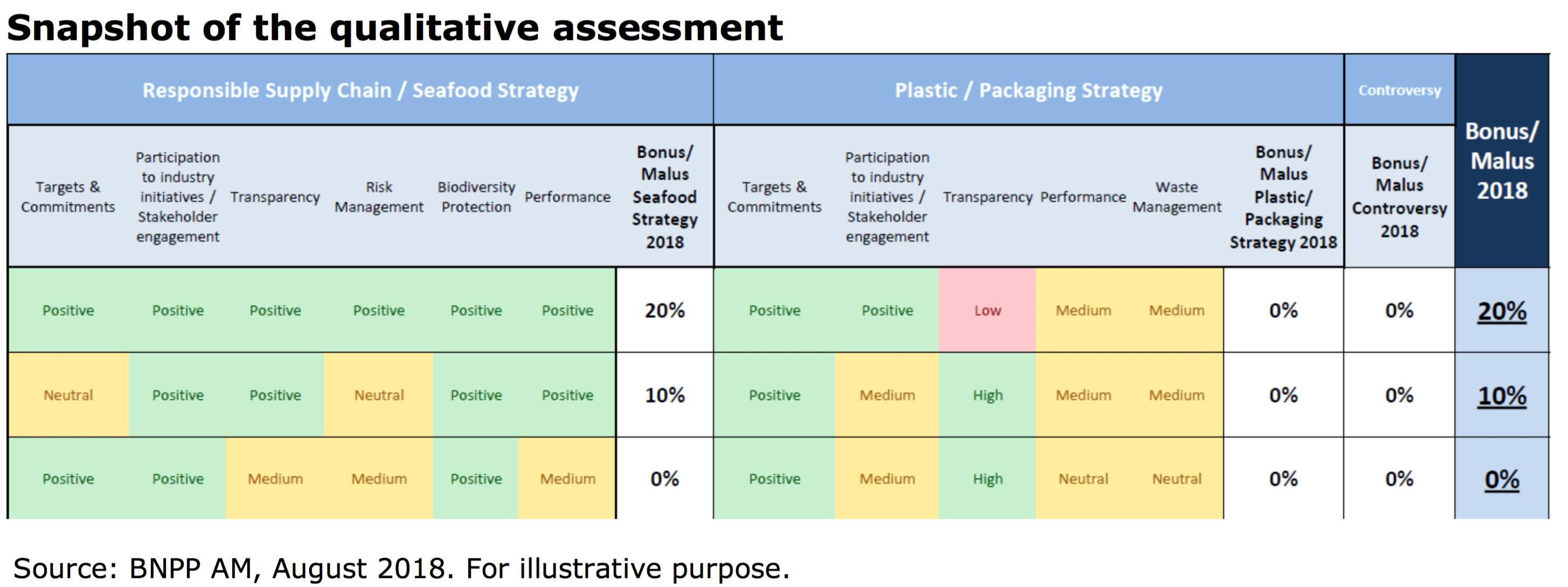

As a final step, we combined the seafood sourcing and plastic/packaging bonus/malus with the controversy malus (where relevant), to determine the overall bonus/malus for the company.

The bonus/malus (up to +/-30%) was applied to the company’s internal quant ESG score, leading to the company’s final ESG score and its decile relative to peers (here, European food retailers).

For more details on the methodology that was used, please refer to section “Appendix: Methodology” at the end of the document.

What were the outcomes of the assessment?

The outcome of the analysis was a bonus/malus ranging from -30% to +30% which was applied to the company’s ESG score and leading to several changes in ESG recommendations, both upwards (e.g. a company moving from neutral to positive) and downwards (e.g. a company moving from neutral to negative).

- Within European food retailers, two companies out of eight were given a bonus, in both cases to reflect their superior sustainable seafood strategy. Meanwhile, three companies were given a malus, mainly due to insufficient plastic/packaging strategy.

- Within soft drinks manufacturers (plastic/packaging assessment only), no company received a bonus while three companies received a malus.

- Within Consumer Home & Personal Care Products (plastic/packaging assessment only), two out of seven companies received a bonus, and one a malus.

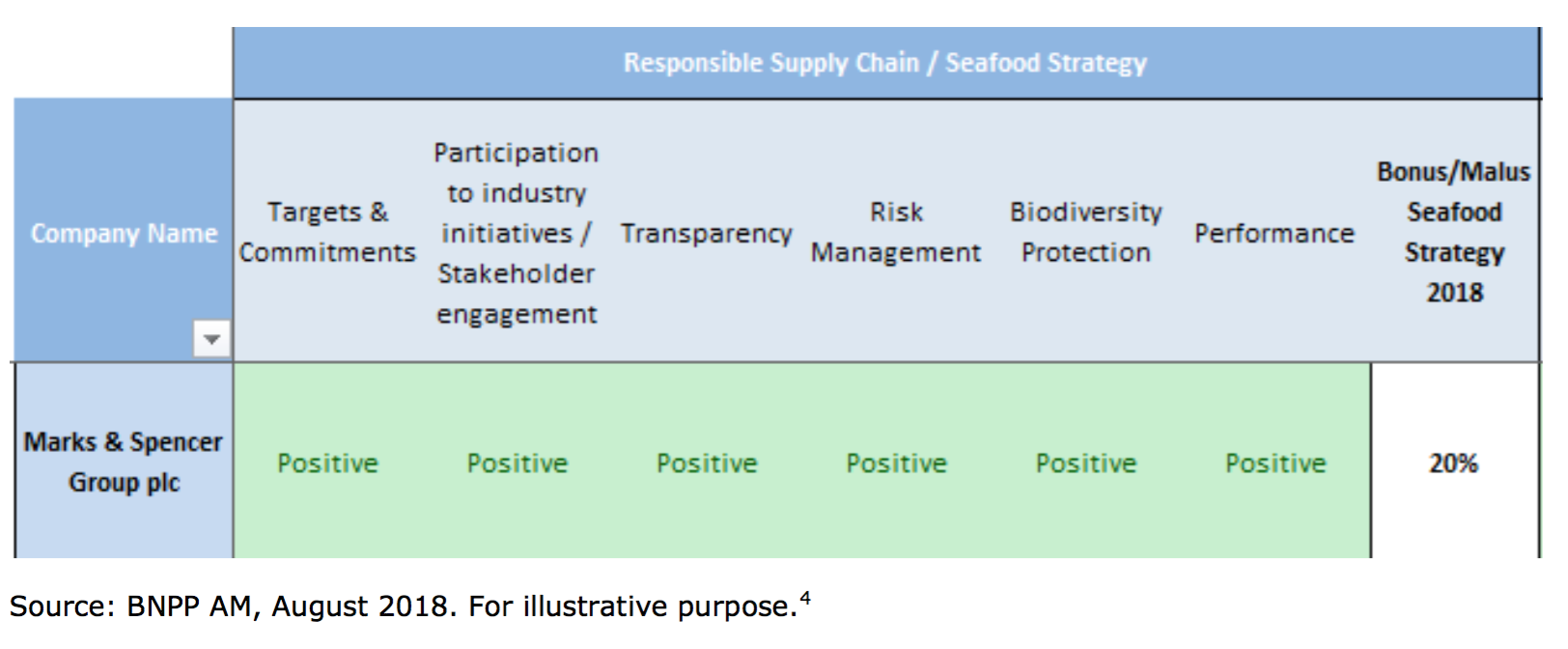

Example of an assessment: Marks & Spencer Group (food retailer)

Marks & Spencer Group (M&S)’s overall performance in the overlay 2018: 20% bonus, due to its 20% bonus assigned for the seafood strategy assessment (no bonus or malus assigned for plastic/packaging strategy).

Targets & Commitments: M&S has had a sustainable fish sourcing policy in place since 1997, with the goal to ensure that all wild-caught and farmed seafood, as well as aquafeed, come from the most responsibly managed sources. By 2021, M&S will strengthen its Forever Fish Programme by rolling out global best practice crew welfare and responsible fishing management, and demonstrating its advocacy for protecting the marine environment.

Participation to industry initiatives / Stakeholder engagement: M&S appears as the most proactive actor. Its historical partnership with WWF (M&S signed the WWF Seafood Charter) helped M&S outperforms its peers. M&S also signed the Global Declaration on Tuna in 2017 to stop illegal tuna from coming to market. It is a founding member of Sustainable Seafood Coalition (SSC). M&S also stresses the importance of education, and as such, is involved in partnerships with the Blue Marine Foundation and the Seafood School at Billingsgate Fish Market.

Transparency: M&S stands out in terms of transparency. It uses 60,000 tonnes of seafood (whole weight), of which 2/3 are wild caught and 1/3 farmed. M&S published an astonishing reporting that includes all species of seafood (wild and farmed) used onsite as a raw material or as an ingredient in finished products.

Risk Management: M&S has a solid risk framework to achieve the full traceability of its seafood and aquafeed. It relies on DNA analysis, traceability checks and is able to trace farmed species back to the farm that produced them, wild fish to at least the group of vessels that caught them, and aquafeed and its key ingredients back to the factories that manufactured them. To fight Illegal, Unreported and Unregulated (IUU) fishing, all fishing boats supplying M&S have to be certified by the Responsible Fishing Scheme (RFS) by 2021, or be actively engaged in a time-bound plan to achieve RFS certification. While this applies worldwide, UK boats were required to gain the certificate or be actively engaged by the end of 2017.

Biodiversity Protection: M&S has a zero tolerance policy on targeted capture and/or the commercial slaughter of non-seafood species such as marine mammals or sea turtles. This zero tolerance policy also applies to trade with any business which participates in the removal of shark fins. M&S has phased-out all fishing of CITES and IUCN listed species and was the first retailer to introduce a ‘pole and line’ only policy for skipjack tuna in 2009. It is also committed to support innovative actions such as gear modification to improve the gear selectivity to avoid non-target catch and to minimize gear impacts on the sea bed.

Performance: 87% sustainable practice applied or participating in a fisheries improvement project for wild caught fish in 2017. M&S will disclose next year its farmed fish performance, but we have no doubt at all on M&S achievements against its targets.

Targets & Commitments:M&S has adopted one of the most ambitious targets in the peer group: 1/ by 2022, it wants to assess the feasibility of making all M&S plastic packaging from one polymer group, which will help maximize the use of recycled content, 2/ By 2022, all M&S product packaging in the UK that could end up with its customers will be not only ‘recyclable’, but ‘widely recycled. Best practice, especially because M&S set a 2022 target date, ie 3 years before the industry common target date, 2025. Nonetheless, we would welcome a commitment to reduce packaging use.

Participation to industry initiatives / Stakeholder engagement:M&S is the most dedicated retailer in the peer group and the only one who participates in the two Ellen McArthur Foundation initiatives (member of New Plastics Initiative and CE100 on the Circular Economy). Also, Marks & Spencer has joined the Global Ghost Gear Initiative (GGGI), a group committed to driving solutions to the problem of lost and abandoned fishing gear worldwide, on World Oceans Day 2018. M&S is also a founding member of the UK Plastics Pact to ‘transform the UK plastic packaging sector.

Transparency:low. We don’t know the estimated use (in tonnes) of materials/plastic in the company’s operations and supply chain, nor the main types of plastic used in products and packaging, broken down by type and volume.

Performance: we don’t have enough elements to assess M&S performance.

Waste management: By 2025, it wants to reduce total waste from M&S Property activities (including packaging) in the UK and Republic of Ireland (ROI) by 50% and will recycle at least 95% of waste that’s produced. It will also strive to maintain zero waste to landfill for M&S operations in the UK and ROI and extend this to its M&S and key franchise operations worldwide by 2025. Good that M&S has a target at group level. In 2017, recycled 100% of the waste generated in its stores, offices and warehouses. In 2017, total waste was reduced by 30%, to 81,000 tonnes (vs 116,000 tonnes in 2008).

How ESG scores impact investment decisions

BNPP AM’s ESG scores (absolute ESG score) and deciles (relative ESG ranking, sector neutral) are disseminated to all portfolio managers and applied in the following ways:

- For SRI best-in-class funds, portfolio managers cannot invest in the bottom three ESG deciles.

- For non-SRI funds, portfolio managers follow an ‘ESG integration’ approach, where ESG analysis is integrated in various stages of the investment process, with the target for all funds to have more favourable ESG characteristics (e.g., a higher ESG score and lower carbon footprint) than their reference benchmark. Furthermore, investment in weakly-rated companies requires investment teams to carry out an additional qualitative analysis integrating ESG factors. Our approach also places a great emphasis on stewardship, using our ESG assessment to actively engage with portfolio companies to promote enhanced sustainability practices.

Communication

BNPP AM shared the outcomes with its institutional clients (mandates). BNPP AM is starting now to disclose more to stakeholders such as civil society (this case study being one example).

Next Steps

At BNPP AM, we have a key role to play to lower our pressure on oceans and contribute to the SDG Goal 14. We are evaluating how we could adopt a formal Ocean policy, which could cover other sectors such as shipping or tourism, in addition to what has been studied.

With this in mind, seafood and plastic will remain key areas of focus for BNPP AM. We will continue to undertake research to raise awareness and understanding of these issues and use our voting policy and stewardship activities to influence stakeholders.

However, we recognise that collective and coordinated action is critical to achieve a material and enduring shift towards sustainable use of natural capital.Therefore we aim to support collaborative engagement with companies, regulators and other stakeholders to focus on the following areas:

- Transparency: Japan, Thailand, Chile, South Korea, China are the top hotspots where we could exercise our leverage to increase corporate’s transparency

- Public policy engagement: lead on getting private and public actors to support an International legally binding Treaty on Plastics as proposed by WWF

- Public policy engagement: lead on getting private and public actors to support an International legally binding “Paris Agreement for the Ocean”: an international legally binding instrument for the conservation and sustainable use of marine biodiversity in areas beyond national jurisdiction (ABNJ)

- Collaborative engagement: launch a collaborative engagement with other investors based on the Global Ghost Gear Initiative

Circular economy: reinforce our collaboration with our stakeholders (Ellen McArthur Foundation, PRI Investor Working Group on Plastics) to reduce our plastic footprint.

Appendix methodology:

Focus A: Seafood sourcing

- Assessment n°1: Targets and commitments

KPIs:

- Targets: commitment to adopt certification and traceability practices

- Commitments: commitment to adopt a responsible seafood policy covering all operations (direct and indirect sourcing), containing details on the type of certification used, social standards, animal welfare standards, etc

Best practice: Sourcing 100% of sustainably-sourced seafood by 2020

- Assessment n°2: Participation to industry initiatives / Stakeholder engagement

Best practices:

- Collaboration with NGOs, such as WWF

- Initiatives: joining or supporting the Global Sustainable Seafood Initiative, North Atlantic Seafood Forum, World Economic Forum (WEF), Sustainable Seafood Coalition, Global Ghost Gear Initiative (GGGI), Marine Stewardship Council (MSC), Seafood Choice Alliance, Sustainable Shrimp Task Force, Ocean Disclosure Project

- Declarations: signing the Tuna 2020 Traceability Declaration, WWF Seafood Charter

- Assessment n°3: Transparency

KPIs:

- Exposure to seafood (sales in EUR million)

Volume of seafood sourced (in tonnes)

- For wild seafood:

- In which FAO areas are target fish captured?

- Is more granular data (smaller areas) for capture locations disclosed?

Is the list of species provided?

- Does the company provide specific names for species where the common name could relate to several different species?

- Does the company provide revenue figures for all main species?

- For aquaculture products:

- Does the company disclose where the farms are located?

- Does the company disclose what species are farmed?

Does the company provide revenue figures for all main species?

- Farmed stocking densities

- Sourcing from fishing vs. aquaculture (volume or sales)

- Assessment n°4: Risk management

KPIs:

- Reaching full traceability of seafood (back to the farm/vessel)

- DNA analysis

- Labour standards / Human rights risk assessment

- Satellite monitoring

- Supply chain engagement / coverage by a Responsible Fishing Scheme

Assessment n°5: Biodiversity protection

KPIs:

- Phase out all fishing of CITES and IUCN listed species

- Ban of destructive fishing methods (by-catch minimization, such as using pole and line instead of FADs)

- Diversified seafood offer

- Other (ex. no sales during breeding season, phase out deep sea species, fish escape management/engagement)

Assessment n°6: Quantitative Performance

KPIs:

- Volume of certified seafood

- Number or percentage of sales of certified seafood

Focus B: Plastic/packaging strategies

- Assessment n°1: Targets & Commitments

KPIs:

- Plastic targets

- Packaging targets

Best practice:

- 100% plastic packaging recyclable, reusable or compostable by 2020

- High average recycled content across all plastic packaging, reduction of packaging use

- Help collect and recycle 100% of the packaging it sells by 2030

Assessment n°2: Participation to industry initiatives / Stakeholder engagement

Best practices:

- Member of Ellen MacArthur’s New Plastics Initiative or CE100

- Signature of key initiatives such as Global Ghost Gear Initiative (GGGI), partner in national schemes (UK Pact)

Assessment n°3: Transparency

Best practices:

- Disclosure of main types of plastic used in products and packaging broken down by type and volume

- Estimated use (in tonnes) of materials/plastic in the company’s operations and supply chain

- Assessment n°4: Performance

Best practices:

- Percentage of the total material/plastic used that is recycled or bio-based content

- Phase-outs / plastic reduction initiatives

- Assessment n°5: Waste management

Best practices:

- Zero waste to landfill by 2020

- Commitment to reduce the amount of waste generated, high recycling and recovery rates

Disclaimer:

BNP PARIBAS ASSET MANAGEMENT France, “the investment management company,” is a simplified joint stock company with its registered office at 1 boulevard Haussmann 75009 Paris, France, RCS Paris 319 378 832, registered with the “Autorité des marchés financiers” under number GP 96002.

This material is issued and has been prepared by the investment management company.

This material is produced for information purposes only and does not constitute:

- an offer to buy nor a solicitation to sell, nor shall it form the basis of or be relied upon in connection with any contract or commitment whatsoever or

- investment advice.

Opinions included in this material constitute the judgement of the investment management company at the time specified and may be subject to change without notice. The investment management company is not obliged to update or alter the information or opinions contained within this material. Investors should consult their own legal and tax advisors in respect of legal, accounting, domicile and tax advice prior to investing in the financial instrument(s) in order to make an independent determination of the suitability and consequences of an investment therein, if permitted. Please note that different types of investments, if contained within this material, involve varying degrees of risk and there can be no assurance that any specific investment may either be suitable, appropriate or profitable for an investor’s investment portfolio.

Given the economic and market risks, there can be no assurance that the financial instrument(s) will achieve its/their investment objectives. Returns may be affected by, amongst other things, investment strategies or objectives of the financial instrument(s) and material market and economic conditions, including interest rates, market terms and general market conditions. The different strategies applied to the financial instruments may have a significant effect on the results portrayed in this material.

All information referred to in the present document is available on www.bnpparibas-am.com