The Finance Supplement provides a framework for financial institutions – including banks, investors and insurers – to measure and value natural capital impacts and dependencies across the entities and portfolios that they finance, invest in or underwrite.

A growing number of financial institutions understand that sustainability or Environmental, Social, and Governance (ESG) issues can create risks for their banking, investment, and insurance outcomes. These institutions are also increasingly recognizing opportunities from active consideration of ESG factors. However, taking action can be perceived as being complex and challenging.

The Finance Supplement was developed to connect natural capital and finance, thereby reducing the barriers to sustainable and effective action from financial institutions.

A capitals approach is designed to generate meaningful, robust and relevant information that can be used to inform decisions around operational, market, reputational and societal risks. It can help financial institutions map and limit their exposure to environmental and social variables across global portfolios, while identifying opportunities to invest in resilient projects and organizations.

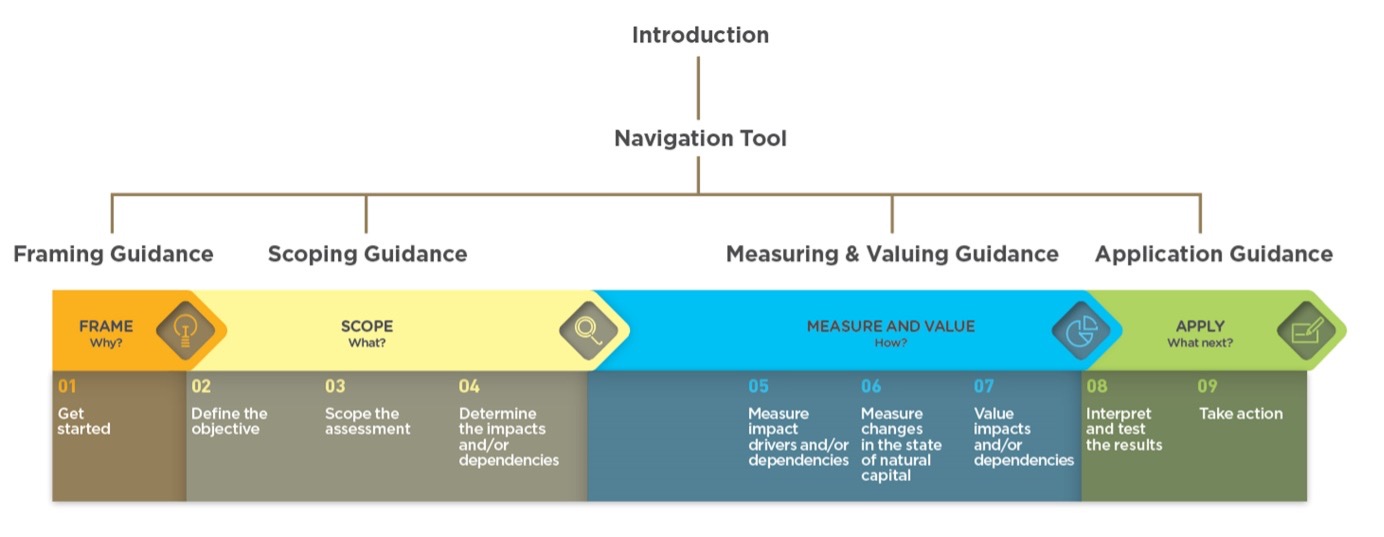

This Supplement builds on the Natural Capital Protocol, providing sector- specific guidance to make the Protocol more applicable and practical for financial institutions.

The Finance Supplement has been designed to align with other initiatives such as the Task Force on Climate-related Financial Disclosures (TCFD) recommendations, which can be implemented alongside the Supplement.

It builds on existing processes and encourages wider discussion around moving from impact to dependency, from measurement to valuation, from stocks to flows, and from separate issues to a system-wide approach.

At BNP Paribas Asset Management, we are very happy to support the Natural Capital Protocol, and the Coalition’s fantastic work to move natural capital higher on companies’ agendas. Today, we have contributed by publishing a case study, focusing on our engagement with companies regarding their consumption of water. Rest assured that this is not a one off, and that we will continue to increase awareness among all of our stakeholders to protect natural capital.

Robert-Alexandre Poujade, BNP Paribas Asset Management

Our participation in the development of Finance Sector Supplement to the Natural Capital Protocol has allowed us to apply this methodology to YES Bank assured green bonds, and to measure the impacts and dependencies of the projects which these bonds have financed. This process has allowed us to improve existing risk mitigation measures and to assess the impacts we are having through the lending of these assets. I would urge other financial institutions to use the Coalition’s Protocol, sector guides and Supplements. They have helped us to assess risks, highlight opportunities and build on our overall organizational strategy

Namita Vikas, Group President & Global Head – Climate Strategy and Responsible Banking, YES BANK