The financial institution in brief:

Kepler Cheuvreux is an independent European Financial services company specialized in advisory services and intermediation to the investment management industry. As part of the equity research team, the ESG (environmental, social and governance) team provides support and analysis on these topics to its investor clients.

Why use natural capital thinking?

Kepler Cheuvreux wanted to investigate whether natural capital principles and accounting could help go beyond carbon and climate-related analysis, to build a broader and interconnected picture of natural capital impacts and dependencies.

Indeed, we believe that climate change is only one part of the story. Certain low- carbon technologies are not necessarily the best option when considering all natural capital impacts together (e.g. nuclear or first-generation biomass). Therefore, if the trend towards portfolio decarbonisation is not matched by a careful review of other natural capital topics, investors may not be minimising the adverse societal impact in a holistic way.

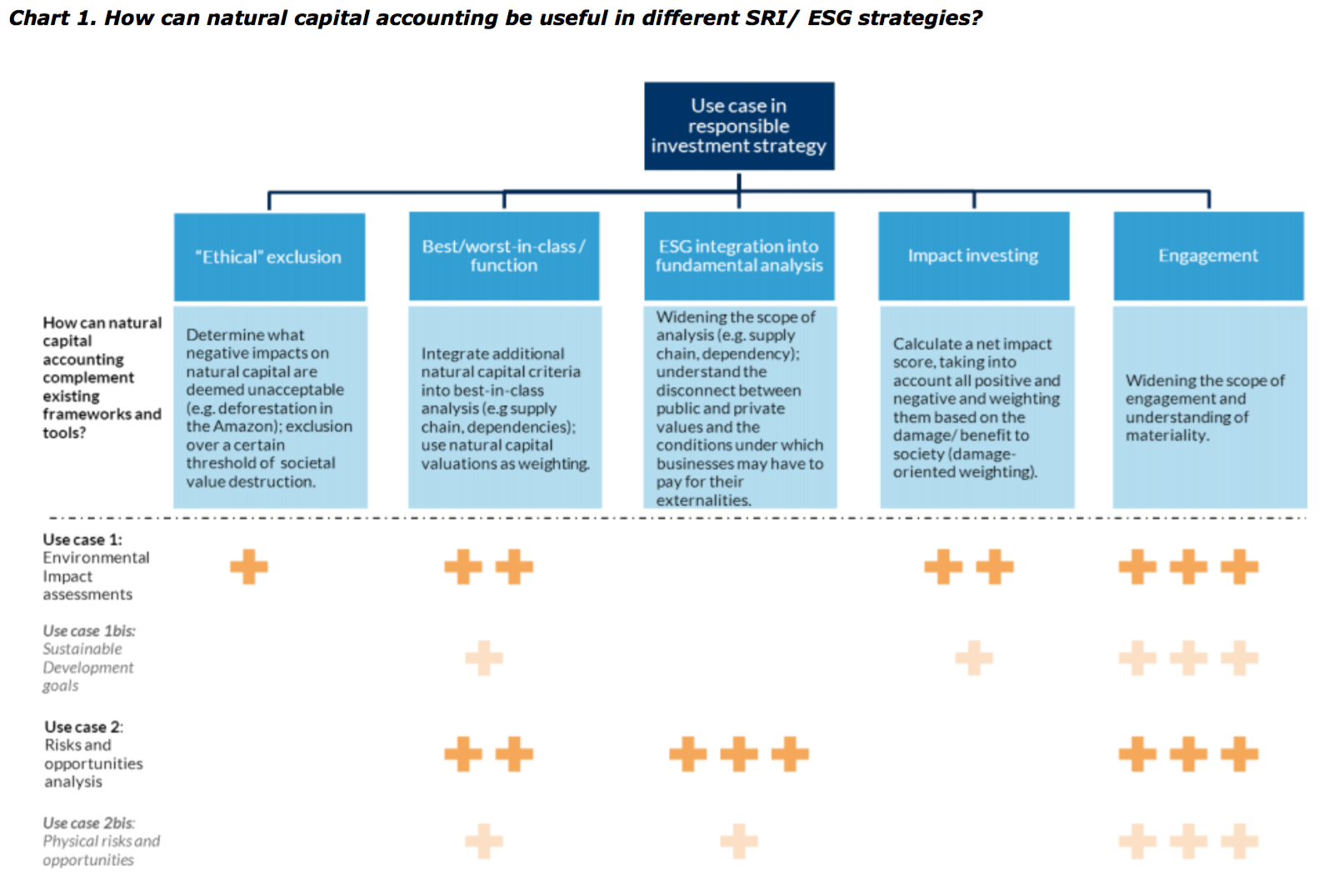

Kepler Cheuvreux clients use a wide range of strategies when it comes to responsible investment, from value-based exclusion to integration in fundamental analysis. Our objective is to highlight and test how natural capital accounting can be used to complement existing tools (such as carbon footprinting and scoring) to analyse environmental topics in a structured and impact-based way.

What was the approach?

Framing “impact” as societal value creation or loss is useful to compare environmental performance across multiple themes and measurement units in a systematic and context-based way.

While the use of granular data is always better and recommended, we wanted to show that a quick high-level screening was possible over a large universe of companies, at least as a first analysis step. To demonstrate this, we build three datasets on the back of publicly-available data from research projects and calculate estimates for 146 sectors and 20 industries:

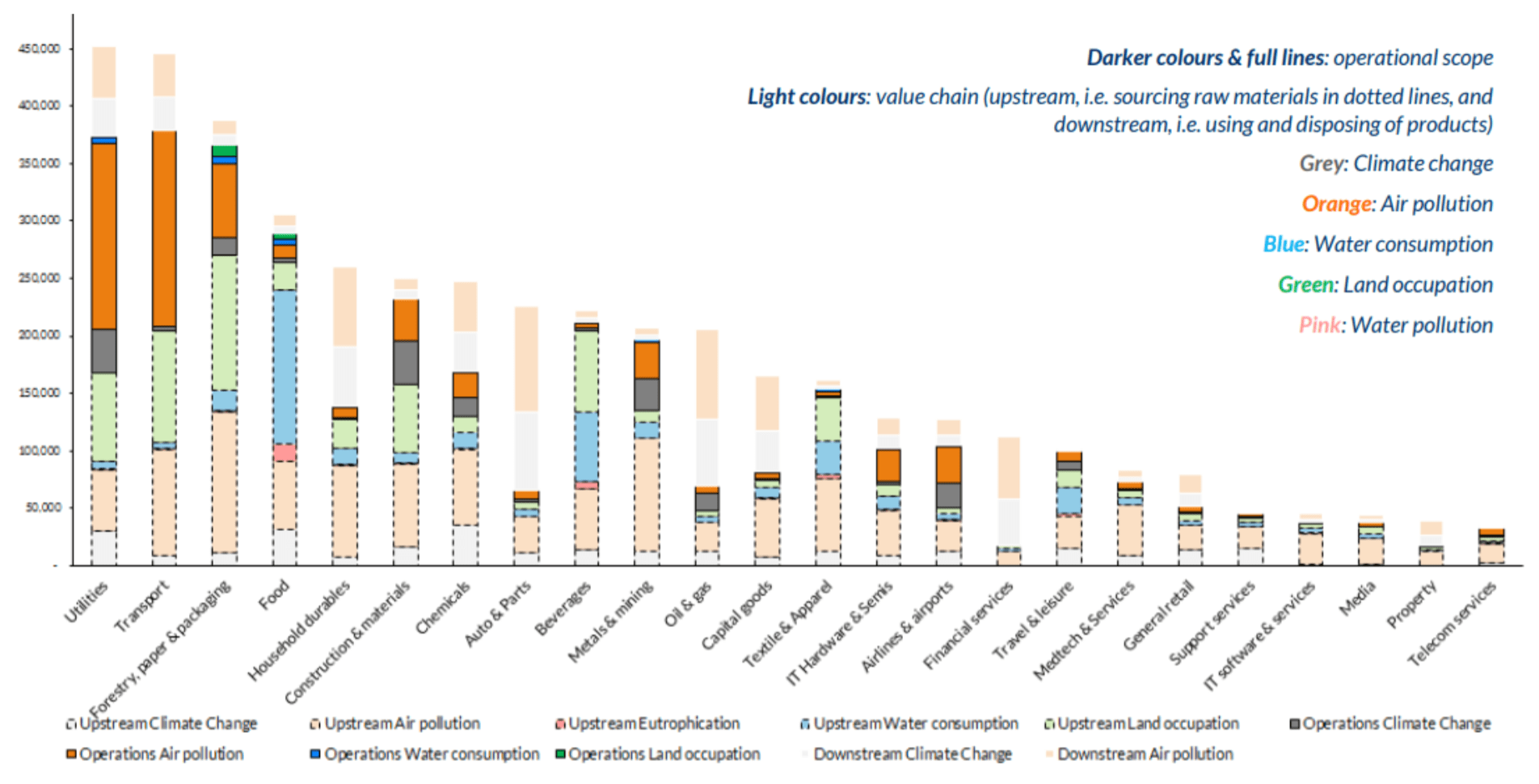

- The use of resources (land, water) and emission of pollution (air including carbon, land, water) per unit of revenue in each sector, both for the direct operations and value chain (upstream and downstream).

- The associated impacts on human and ecosystem health.

- The total value that was lost to society due to these impacts.

Kepler Cheuvreux then applied these dataset to assess the natural capital impact of the 700+ companies covered directly by its equity research, across sectors but limited to companies publicly-listed in Europe.

What were the outcomes of the assessment?

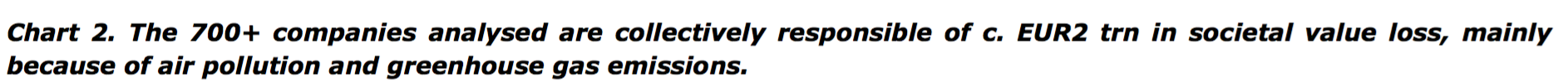

We found that the 700+ companies within the scope of our analysis collectively affected negatively over 2,500+ species for a year (or c. 1.5% of global species) and over 150m of healthy years of life through premature mortality and morbidity, a year.

Based on these figures, they are responsible for over EUR2,000bn in societal value loss, or around EUR150,000 of every million euros of revenue generated. 20% of this value is attributable to carbon with our current estimates, but it could be as high as 50% with more conservative data.

Overall, the utilities, transport, oil & gas, auto & parts, capital goods, chemicals, metals & mining, and food sectors contribute the most to the overall environmental impact of our coverage universe, from an absolute perspective.

We found a strong correlation at the industry level between Scope 1, 2 and 3 (full value chain) greenhouse gas impact and Scope 1, 2 and 3 total environmental impact, hinting that industries that are the most carbon-intensive are also the most environmentally-intensive. At the company level, the correlation is weaker, which illustrates the potential of this analysis when using it at the company level.

Next steps

In our view, this type of analysis can be used in several ways:

- Internal and external communication to raise awareness on the importance of systemic thinking and thinking “bigger than carbon”.

- Quick, high-level and sector-based screening to identify hotspots.

- Impact-and-science-based weighting mechanism for the “E” part in ESG scoring (by using monetary valuations).

- Opportunity sizing.

As next steps, we would like to drill down into specific sectors and companies to refine the estimates and include the positive side of the story (i.e. not only societal value loss but also creation), as eftec did as part of a case study in our collaborative report “Bigger than Carbon: A systemic View”.